Enabling Embedded Finance | IMTC 2022

Get inspired by this revived W.H. Auden’s Hymn to the United Nations. “Let music for peace Be the paradigm, For peace means to change At the right time, As the

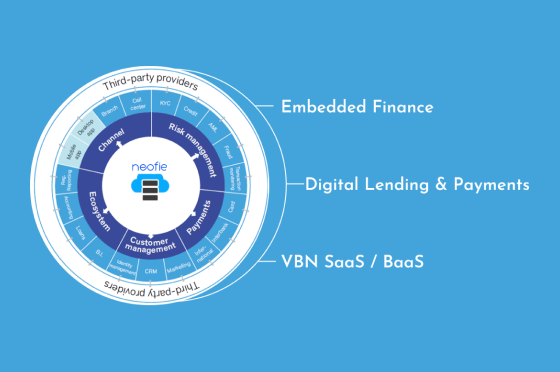

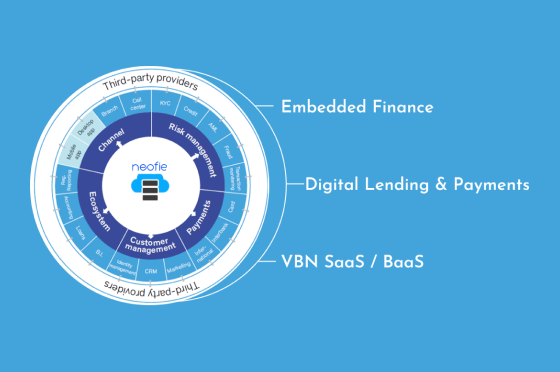

Neofie is a layered BaaS (Banking as a Service) provider with a wide range of capabilities to support your fintech plan. From launching a turnkey white-label Neobank, to a digital core banking solution, to layering a lending platform into your existing infrastructure, we can adapt the offering to fit your needs.

Neofie is a layered BaaS (Banking as a Service) provider with a wide range of capabilities to support FinTech plans. From launching a turnkey white-label Neobank, to a digital core banking solution, to layering a lending platform into existing infrastructures, Neofie BaaS can adapt the offering to fit most business needs.

At Neofie, we have a great experience across the financial services sector, working with clients and partners to provide next-generation

FinTech products with in-depth experiences, and world class engineering capabilities. We combine architectural and subject matter

expertise to help organizations evolve towards more effective technology and business infrastructures.

We are in Atlanta, Los Angeles, Austin, Toronto, Bogota, Milan and Beirut.

Neofie is a layered BaaS (Banking as a Service) provider with a wide range of capabilities to support FinTech plans. From launching a turnkey white-label Neobank, to a digital core banking solution, to layering a lending platform into existing infrastructures, Neofie BaaS can adapt the offering to fit most business needs.

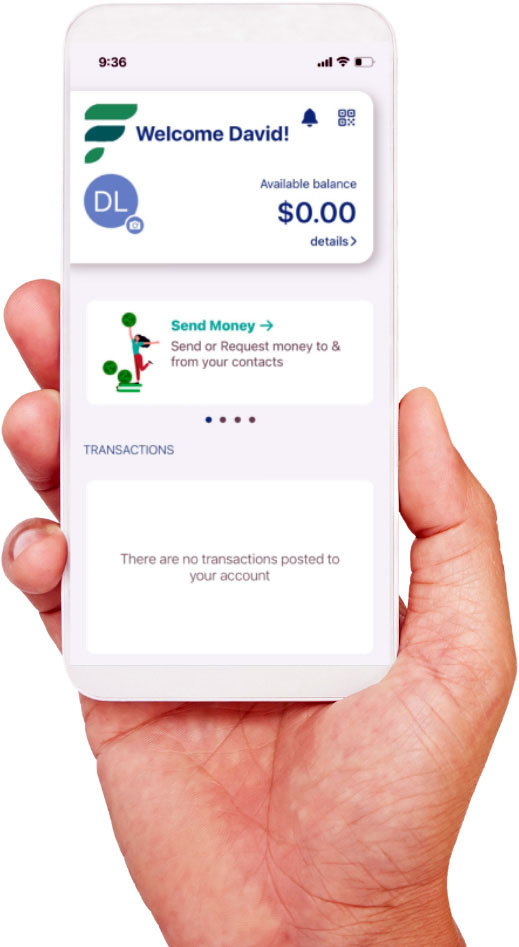

Neofie turnkey Banking-as-a-Service approach is to minimize the client-partner work by providing all the platform elements in one box: digital core technology, web and mobile app, payment switch, processing, bank sponsorship and KYC/AML. This enables the client-partner to focus on customer acquisition and marketing, while Neofie manages the technical and compliance details.

Neofie’s White Label Program facilitates building efficiently and rapidly cost-effective digital banking products to serve, expand, and grow business relationships with end-users.

Demand for mobile financial services is soaring and shifting the banking approach. Neofie provides the required integrated finance and FinTech solutions, with security and compliance and a simplified back-end process for clients to focus on consumers acquisition and customer relationship.

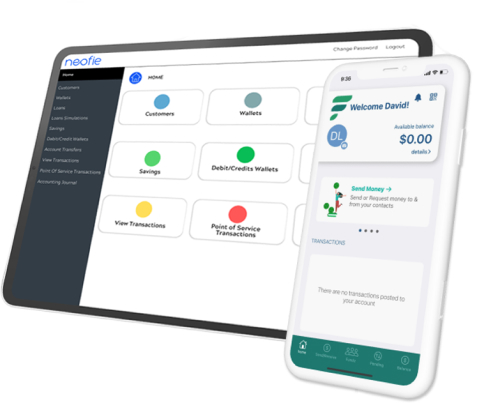

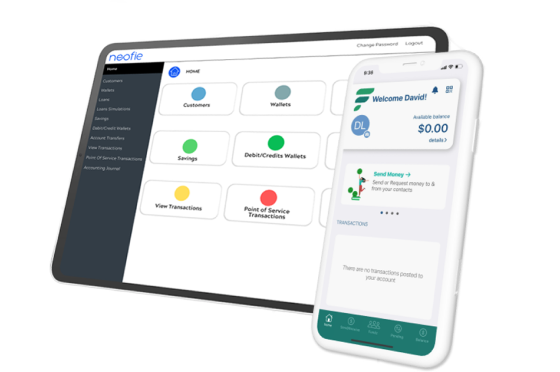

Neofie Digital Core Banking (NDCB) is the accelerated and cost efficient path to digitalizing the bank’s infrastructure, ledger and end-user experience. NDCB is a comprehensive cloud-native financial services platform to directly acquire, track, and serve bank customers through mobile devices. Neofie platform can be hosted on the cloud to facilitate and enhance customer management, product offerings, settlements, accounting, reporting, and business governance while providing real-time processing for the financial services requirements.

Neofie’s cloud-native platform is equipped to support true contemporary end-user centric digital banking. Neofie BaaS provides customers with real-time access to banking services such as deposits, account inquiries, and fund transfers, and supports multi-lingual and multi-currencies operations.

Thanks to the extensive adoption of Application Programming Interfaces (APIs) to access third parties’ new services the Neofie BaaS platform provides all the elements needed for open banking, it can facilitate digital transformation to increase transparency and enhance the customer experience. The BaaS model allows financial services providers and non-financial businesses to connect with banks’ systems directly via APIs to offer their customers personalized banking products and services under their own brands.

Neofie provide banks a low-cost digital transformation design and implementation method and plan to enhance customers experience and improve service quality, while significantly reducing the operating costs.

Neofie digital banking platform is engineered to deliver a comprehensive turnkey solution that meets the evolving needs of existing clients looking for a new digitally improved customer experience.

Neofie provides a product suite optimized for every part of the value chain; it can be accessed by a non-financial service provider through Neofie’s agile and lean frameworks to rapidly respond to market demands.

Neofie can deliver an effective way to build brand loyalty programs and reassure customers by keeping them up to date with changing information about their bank and financial accounts.

By signing up, you agree to the Terms of Service.

Tackling BaaS can be a daunting task. It means building a back-end system, setting up apps, creating all the APIs and partner agreements to offer the product(s). It also means navigating demanding compliance rules and operational hurdles, as well as ensuring that the infrastructure is prepared to handle the integrations necessary to run a BaaS operation, and the high volume of activities that come with it. Neofie can provide the Technology, Banking, & Compliance expertise for challenger banking, neobanks and MNOs.

Neofie is backed by:

Neofie offers a turnkey private-label neobank solution handling the technology and compliance requirements, for clients to focus on the end customers and their brand. Neofie operates the neobanks under its client’s brand strategy, rules, and parameters to enhance their focus on customer enrollment and retention, success, and to augment the brand’s scope into a profitable consumers’ offering.

Since Neofie’s offerings are based on a digital banking platform, Neofie presents the option to offer multiple types of deposit and lending products. Deposits can be as varied as checking accounts, saving accounts, and high-interest yielding term accounts. Loans can be revolving, terms, installments, or BNPL type accounts. Neofie can also do merchant acquisition at competitive interchange rates and create a closed-loop payment system saving merchant interchange costs.

There is no area more important to the bank sponsors than to provide the KYC, AML compliance, and Anti-Fraud support required to protect the business. Designed for banks,

Neofie professionals bring years of industry expertise and the digital core banking platform ensures regulatory compliance to facilitate the setup of policies and procedures. Neofie also provides ongoing support and monitoring of customers and transactions for banks to remain compliant with local regulatory and business standards.

At Neofie, we provide the BaaS (Backend as a Service) platform for your banking needs, like mobile apps, cards, and other customer and business services.

The latest articles and news on Fintech’s, BaaS, Crypto, Embedded Finance, and so much more…

Get inspired by this revived W.H. Auden’s Hymn to the United Nations. “Let music for peace Be the paradigm, For peace means to change At the right time, As the

Get inspired by this revived W.H. Auden’s Hymn to the United Nations. “Let music for peace Be the paradigm, For peace means to change At the right time, As the

Get inspired by this revived W.H. Auden’s Hymn to the United Nations. “Let music for peace Be the paradigm, For peace means to change At the right time, As the