About Neofie

Neofie is a layered BaaS (Banking as a Service) provider with a wide range of capabilities to support FinTech plans. From launching a turnkey white-label neobank, to deploying a full digital core banking solution, to layering a lending platform into existing infrastructures, Neofie can adjust the offering to fit the exact requirements.

About Neofie

Neofie is a layered BaaS (Banking as a Service) provider with a wide range of capabilities to support FinTech plans. From launching a turnkey white-label neobank, to deploying a full digital core banking solution, to layering a lending platform into existing infrastructures, Neofie can adjust the offering to fit the exact requirements.

Who We Are

Neofie focuses on enabling financial organizations to leverage digital banking platforms and better serve the contemporary FinTech users. Neofie is in Atlanta, Los Angeles, Austin, Toronto, Bogota, Milan and Beirut.

Built for Rapid Deployments

- International team

- Labs in USA and Europe

- Presence in 10+ countries

- Enterprise-grade resources

Business Model

- FinTech, Channel Partners, Telcos/MNOs,

Trusted Network - Licensing, Management

- Processing Fees

- Lending Programs (Nano, Micro, Supply-

chain Loans)

Our Mission

- Neofie enables financial organizations to

leverage the Neofie BaaS cloud-native

portfolio - Financial software products to deliver fast

- Robust and comprehensive banking

services

Neofie BaaS & Open APIs

- Digital First, Real-time Products & Services

- Comprehensive BaaS Platform for MNOs, Neo/Challenger banking, FinTech

- Neofie “Network” for Partners/Clients

Platform & Products

- Neofie BaaS with Open APIs

- Cloud-native Back-End for Payments,

Rewards, Loyalty & Analytics - Mobile Banking

- “Virtual Invisible Network” virtual ATM

Why Neofie

- Neofie BaaS with Open APIs

- Cloud-native Back-End for Payments,

Rewards, Loyalty & Analytics - Mobile Banking

- “Virtual Invisible Network” virtual ATM

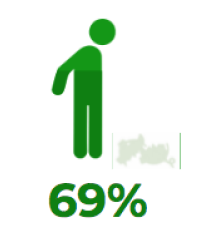

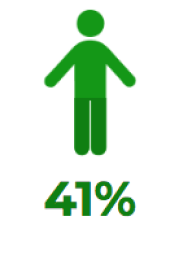

Did you know?

or underbanked.

paycheck*

to $400-500 for an

emergency expense

$1,000 in savings

scores less

than 700

Our Mission

Neofie has the goal of making financial services a better industry by focusing on mobile and digital financial platforms for contemporary needs on how they should be designed, built, and scaled. Understanding financial services and vertical requirements, and leveraging technology using lean processes is the key to providing the right mix of innovative products and fast implementation approaches.

Why Neofie?

Neofie can address and resolve requirements of financial services organizations looking for agility, innovation, and/or are dissatisfied with their current options. Neofie can help with its genuinely cloud-native products by applying the latest mobile technologies to leverage the end-user time online to deliver better service, reduce costs, and access other products through personalized mobile/digital services.

Meet Our Team

We believe that transparency, teamwork, technology and collaboration are essential to progress.

Nabil Kabbani CEO

Kabbani is a global CEO in Fintech. He ran several businesses over twelve years at Western Union, helping it grow to a multi-billion dollar public company working from various locations in the U.S., Beirut, Dubai, Paris and Brussels. He has led VC and PE funded businesses at various stages, is versed in M&A and fundraising. He has grown several businesses multi-folds and is a regular industry speaker.

David Hanna Chairman

Chairman of the Board and co-founder of Atlanticus Holdings Corporation, serving 17 M customers delivering > $10 B in lending products. David is a Trustee and co-founder of Holy Spirit Preparatory School in Atlanta, Georgia. Director of Piedmont Healthcare in Atlanta. Board of Trustees of the Lumen Institute and the Knights of Malta. David Hanna is co-founder of NEOFIE.

Ricardo Giovannone CTO

Ricardo supervises the NEOFIE BaaS and Product Suite, the software labs, and the R&D of new products. Being a technology expert, he manages the integration and delivery of NEOFIE products in the target markets. As VP of Integration at a First Boston-Credit Suisse/IBM, Ricardo has extensive experience in managing large scale and/or mission critical programs and platforms in multiple Global Financial System deployments.

Giovanni DalMaso COO

Giovanni supervises the company operations and the portfolio of NEOFIE’s offerings by leveraging the experience of executive roles held in FinTech, software, and technology companies. He is skilled in alignment of business & technology and deployment of global operating models. He has worked in Europe, UK, Switzerland, and USA and his professional career has been consistently in the hi-tech.

Johnny Wright Board Member

Johnny Wright has come to be known as one of the foremost music managers of all time. Through hard work, creativity and a strong sense of commitment he has developed successful ventures from music management to film and television production. He is currently CEO of Wright Entertainment Group (WEG) and No. 83 on The 2015 Billboard Power 100 which roster includes Justin Timberlake, Lance Bass, Akon and Incubus.

Jeff Howard Board Member

CEO of Atlanticus, has been President and a director since April 2001 and has served as Executive Managing Director and as Director of Corporate Development since 2001. He runs company’s operations and has insightful institutional knowledge. In addition to his 17 years of experience in the consumer finance industry, Mr. Howard has significant experience in corporate development.